Worried About the Market? Protect Yourself with Valuation.

What You’ll Learn

- Why value investing is hard when the market keeps going up

- The type of noise you need to to ignore

- What type of advice to listen to

- Why valuation is key to any investment success

I’m a simple person.

If the stock market goes up or down, it’s a win-win.

Down means more stocks to pick up. Up means my stocks appreciate.

But if you’re not a fan of what’s happening today where any slight news seems to send the market up or down 1%, what’s your game plan?

Do you have one?

The market has been surprisingly resilient so far.

Driven in large by the large tech companies where the IT sector now makes up 25% of the S&P. The top 3 sectors – IT, Financials and Health Care, now make up over 50% of the S&P500.

- Facebook took a slight tap to the wrist, but that’s about it.

- Amazon continues to climb the ladder of world domination.

- Netflix is back to posting monstrous numbers.

- Google is minting money off your privacy.

The FANG stocks are definitely helping the stock market climb higher. If you don’t have FANG in your portfolio, you’re missing out.

Jim Cramer and his FANG | source: CNBC

Only recently has the small dip in FB convinced me to dip my toes into the first letter of the FANG.

But at the same time, herein lies the problem. The fear of missing out and only thinking about the upside.

Now Cramer is an entertainer first and foremost. His excitement, enthusiasm and array of buzzers make a boring topic fun to watch.

At the same time, he says things like:

the simple fact is that the world loves Netflix. We’re beginning to believe that it could easily reach 300 million subscribers someday and they’ll be willing to pay a heck of a lot more for the service. Why? Because it is such a bargain.

Worried about the political risk in the market?

Cramer suggested investors look to the FANG stocks as a safe haven from the geopolitical concerns.

Howard Marks takes an opposite approach.

The riskiest thing in the investment world is the belief that there’s no risk. On the other hand, a high level of risk consciousness tends to mitigate risk. I call this the perversity of risk. – Howard Marks

Seth Klarman is an investor I follow regularly. His Baupost group goes after complicated ideas and transactions but his process and fundamental reasoning is top notch.

When it comes to the market, he too has a different take.

Although markets are increasingly expensive, diamonds in the rough are out there, and the only way to be successful in the markets when things get more interesting is to relentlessly comb the markets and fill the idea pipeline. Years of increasing investor complacency inevitably sow the seeds of future dislocation and opportunity. But for now, we will have to work harder with less to show for it. – Source: Business Insider

Although Baupost under-performed by returning single digits compared to the S&P’s 21%, Klarman’s fund has been able to annihilate the market over the life of the fund by holding large sums of cash. Looks Baupost was holding 36% in cash at the end of 2017, even after they returned some to investors.

Before I continue, click on the image below to be a VIP and get all the hidden content and exclusive resources we don’t publish anywhere else.

So far, if you’ve been in the market long enough, you know that history rhymes. Here’s an excerpt from the Baupost 2004 year end letter.

It wouldn’t be overstating the case to say that investors face a crisis of low returns: less than they want or expect, and less than many of them need. Investors must choose between two alternatives. One is to hold stocks and bonds at the historically high prices that prevail in today’s markets, locking in what would traditionally have been sub-par returns. If prices never drop, causing returns to revert to more normal levels, this will have been the right decision. However, if prices decline, raising prospective returns on securities, investors will experience potentially substantial mark to market losses, thereby faring considerably worse than if they had been more patient.

The alternative is to remain liquid, defy the steady drumbeat of performance pressures, and wait for the prices of at least some securities to drop. (One doesn’t need the entire market to become inexpensive to put significant money to work, just a limited number of securities.) This path also involves risk in that there is no certainty whether or when this will occur; indeed, securities prices could rise further from today’s lofty levels, making the decision to hold cash even more painful. Meanwhile, holding out for better returns involves a (potentially lengthy) period of very low (albeit certain) positive returns available from today’s short-term U.S. Treasury instruments.

Sound eerily familiar?

Well Howard Marks echoes similar thoughts and gives his take on how people view risk.

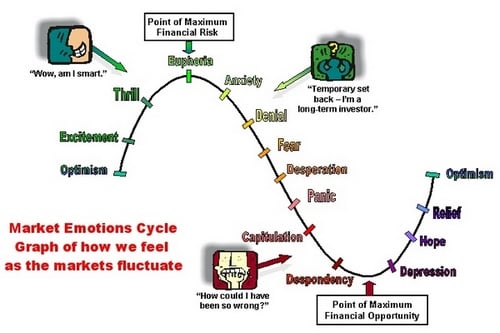

1. When economic growth is slow or negative and markets are weak, most people worry about losing money and disregard the risk of missing opportunities. Only a few stout-hearted contrarians are capable of imaging that improvement is possible.

2. Then the economy shows some signs of life, and corporate earnings begin to move up rather than down.

3. Sooner or later , economic growth takes hold visibly and earnings show surprising gains.

4. This excess of reality over expectations causes security prices to start moving up.

5. Because of those gains – along with the improving economic and coporate news – the average investor realizes that improvement is actually underway. Confidence rises. Investors feel richer and smarter, forget their prior bad experience, and extrapolate the recent progress.

6. Skepticism and caution abate; optimism and aggressiveness take their place.

7. Anyone who’s been sitting out the dance experiences the pain of watching form the sidelines as assets appreciate. The bystanders feel regret and are gradually suckered in.

8. The longer this process goes on, the more enthusiasm for investments rises and resistance subsides. People worry less about losing money and more about missing opportunities.

9. Risk aversion evaporates and invests behave more aggressively. People begin to have difficulty imagining how losses could ever occur.

Source – Howard Marks

Make Objective Decisions with Buy and Sell Rules

To combat some of the common psychological pitfalls of wanting to buy stocks and be “active”, you should have clear buy and sell rules.

A lot like traders.

You can learn a lot from the good ones. The analysis and thought process is different, but the approach and execution is something value investors can benefit from.

Are you still sizing your positions based on how much you like the company story and what your gut tells you, rather than hard rules?

I’ve posted a topic on the Kelly formula which is one way to define sizing and buying rules. Using the Kelly Formula in investing is more difficult than it sounds. Take it as an idea and framework – a good kick start to help get your ideas flowing to implement for yourself.

A buy signal can be triggered by something as simple as a stock price meeting your 25% margin of safety price.

Nothing fancy.

Just a simple criteria to make it black and white because an investment ultimately has to be tagged with a yes or a no. The process and analytics may be complicated, but the final decision is binary.

Some extra ideas that you could use in no particular order.

- Summarize and score your investments based on 3 categories: Quality, Value and Growth. Does the new stock look better than what you already have? Maybe an existing one is less impressive than you thought.

- Ease into the position. Buy 50% first, and then buy the next 50% as you become more confident.

- Sell half the position at intrinsic value to lock in gains.

- Sell 10% below your fair value to capture and lock in gains.

- Be more active of your buying and selling rules

Valuation, Valuation, Valuation

When buying real estate, they say it’s all about location, location, location.

But with valuation, the most important factor comes down to valuation.

I’m using Klarman a lot in this article. But here is a past situation where his valuation and conviction to continue buying at cheap prices yielded huge returns before the company was bought out by Merck.

For billion dollar funds, you don’t see many holdings go up 200% in a day.

Klarman wins big with IDIX

It’s the same for small investors like you and me.

The only way to do well in the market is to value stocks and know what price range to be buying in.

Notice in the chart above that Klarman was buying at various prices over a couple of years.

He knew that anything below $7 or $8 was a bargain compared to the intrinsic value.

I admit, I’ll find it difficult to buy at $8 if I was picking up shares at $4 or $5 earlier. But that’s the importance of knowing your intrinsic value as it alleviates anchoring bias.

Phil Fisher says it best.

Don’t quibble over eighths and quarters. – Phil Fisher

With IT, Financials and Healthcare eating up 50% of the S&P500, if these sectors start falling, knowing what to buy becomes even more important.

The Right Way to Value Stocks for Outperformance

You know that I use many valuation methods, and I don’t like to waste time trying to perform the same calculations stock after stock.

Here’s a list of the best stock valuation methods that I use.

Follow the tutorials for the DCF, Graham’s Formula, Absolute PE, EBIT valuation and others to see how you can come up with a fair value range. The goal of knowing when to buy is to be approximately right and avoid the absolutely wrongs.

It’s easy for me and OSV members because I’ve automated the time consuming and mundane aspects of stock analysis and valuation with the Old School Value Stock Analyzer.

I can quickly narrow down on the company, the story, the business and decide on the inputs based on my findings. Beats splattering around trying to stumble on an opportunity.

I’ll be the first to admit that I can’t compute calculations in my head like Buffett and Munger. That goes for many people – especially if your full time job is not investing related.

But if you are serious about empowering yourself to pick stocks and calculating intrinsic value on your own, see if Old School Value can help you out. You can use it for free for AMZN, AAPL, FB.

If IT is so hot right now, why? And how much should you pay?

By simplifying and automating the valuation process, you’re going to be ahead of 90% of the investing population. Keep the valuation process consistent and objective and it’s easier to ignore the noise and focus on what the data is telling you.

Since I easily get my range of intrinsic values (bear case, base and optimistic case) I can then execute my moves based on the price compared to my estimates.

While headlines scare you into believing that a company like FB is going to be regulated and run to the ground, the data is telling me that it’s an exaggeration.

The numbers don’t lie.

Word of caution. A lot of bias comes into play when you try to manually value stocks from scratch. You end up doing so much work that you feel obligated to buy.

Not Buying is Outperforming

On the flip side, being able to analyze and calculate intrinsic value, also helps you clearly know what NOT to buy.

If you’ve ever participated or watched an auction, there are always people who get into bidding wars and overpay.

Same thing happens on eBay. I wanted to buy a used small camera for vacationing purposes.

Bidding started slow and picked up towards ending time.

I was out of the race in no time.

By the time the auction ended, a used camera 1 year old camera was only 10% cheaper than at full retail price.

This happens all the time.

Everyone has a plan ’till they get punched in the mouth.- Mike Tyson

But the plan crumbles as compromise sets in and they raise their buy price little by little. Soon they are 10-30% over their limit and buying at a loss.

Summary

- Value investing is hard when the market keeps going up

- The market and media will keep feeding your senses with what to buy

- Ignoring media and news and following sound advice like Howard Marks and Seth Klarman will help your portfolio

- Valuation is key to any investment success

- Have buy and sell rules handy

- Learn how to value stocks

- Don’t fret over missed opportunities

- Passing on bad stocks is equally profitable