K-Swiss Valuation (KSWS)

Value stock or value trap? K-Swiss, a simple, easy to understand business which is probably within everybody’s circle of competence. K-Swiss operates in the athletic footwear business designing and marketing mainly tennis and casual shoes to the teen market. Currently down to the $16’s, how is it as an investment?

Business Summary

Shoe business is a simple to understand business.

Design shoes, get orders, manufacture it in cheap labor countries, ship it to its international business locations, sell them to customers who in turn sell it to consumers.

K-Swiss main product base is focused on tennis and casual shoes, with the “Classic” being the best selling item.

From the 2007 annual report: “K-Swiss was founded in 1966 by two Swiss brothers, who introduced one of the first leather tennis shoes in the United States. The shoe, the K-Swiss Classic has remained relatively unchanged from its original design, and accounts for a significant portion of our sales. The Classic has evolved from a high-performance shoe into a casual, lifestyle shoe. In our marketing, we have consistently emphasized our commitment to produce products of high quality and enduring style and we plan to continue to emphasize the high quality and classic design of our products as we introduce new models of athletic footwear.

On December 30, 1986, K-Swiss was purchased by an investment group led by our current Chairman of the Board and President, Steven Nichols. Thereafter we recruited experienced management and reduced manufacturing costs by increasing offshore production and entering into new, lower cost purchasing arrangements…

In November 2001, we acquired the worldwide rights and business of Royal Elastics an Australian-based designer and manufacturer of elasticated footwear. The purchase excluded distribution rights in Australia, which were retained by Royal Management Pty, Ltd. In the third quarter of 2005, Royal Elastics launched a new collection that is part of a long-term licensing partnership with L.A.M.B.”

The company is organized into three geographic regions: the United States, Europe and Other International operations.

Growth Strategy

With the “Classic” shoe making up 69% of its sales, sagging sales of the Classic domestically has caused revenue to plummet by as much as 20%. That’s the source of the problem with KSWS. With the Classic taking up so much of its sales, if demand drops, then there is no other product in their portfolio to recuperate that big offset. The Classic has been a good wave to ride for over 20 years but now KSWS is finally introducing new designs and trying to penetrate niche markets.

Recently KSWS has launched its new line of free running shoes with Sebastien Foucan, the creator of parkour or free running to promote the shoe. You also saw him in that awesome action opening sequence of James Bond; Casino Royale. Free running has seen big growth as a sport in Europe and KSWS is trying to capitalize on that by bringing it to the United States with its Ariake shoes. Currently, there is no company that designs and markets specific to free running, not even Nike or Adidas, so KSWS is trying to establish itself as the first player in this niche.

KSWS isn’t as well known as its competition. Think of an athletic shoe company and the first name to pop up is probably Nike. To create some brand awareness, KSWS has been investing heavily in its marketing campaign. They’ve come up with a new “Keep it pure” slogan as well as signing up Anna Kournikova as its spokesperson to attract attention to its tennis heritage and emphasis. As well as creating a shoe for DCMA, a clothing line created by Joel and Benji from the band Good Charlotte, it seems like KSWS is trying as hard as possible to produce growth and get its name out there.

Although US sales have been dropping, international sales have been showing good growth and demand. Watch for sales overseas to exceed domestic sales soon.

Competitive Position

A small company in the footwear industry doesn’t have much lasting competitive advantage over the big boys. K-Swiss does not have the economies of scale to be able to compete effectively with Nike or Adidas. But one thing K-Swiss and the other smaller players can do that the Nike’s and Adidas’ can’t is focusing on niche markets. However, this obvious fact isn’t really a competitive advantage.

The one that K-Swiss claim themselves is their lasting designs. As you read above in the business summary, the overall Classic design has barely changed. Sure there has been updates to keep it with the times, but the design is practically the same. This means K-Swiss does not have to spend resources on designing and manufacturing new shoe designs every season.

K-Swiss only sell their shoes to “middle upper” class retailers. You won’t see their shoes on the wall with a big discount sticker attached at Payless Shoes or Big 40. K-Swiss are strict about being seen with the right retailers to ensure their name isnt referenced as “cheap” or “bargain”. They want to maintain their high end image. K-Swiss also has strict pricing policies with very little discounts and sales. Their high margin also allows their retailer customers to benefit from higher than usual margins. This has allowed K-Swiss to earn a median of 10% net income for the past 10 years.

However, all of this still amounts to a very narrow moat and one of Buffett’s quotes comes to mind.

I say to myself, give me a billion dollars and how much can I hurt the guy?

Risks

K-Swiss is currently facing the consequences of their risk. Their sales were based around mostly 1 product and now that it is losing its edge, the company is finding it hard to bring in revenue.

K-Swiss is definitely in a turnaround phase and the big risk is that K-Swiss won’t be able to turn it around. However, the current management team has been through 2-3 such cycles and have come out better each time.

Futures orders have also dropped significantly domestically, down 40% but international futures orders rose 14%. Sales to Foot Locker, its biggest customer, accounted for 13% of revenue while no other customer accounted for more than 10% of total revenues. Therefore if Foot Locker decides to cut back on orders, that is a big chunk of revenue K-Swiss will lose.

Management

I wrote some points about KSWS management in the dual class shares and K-Swiss post. I’ll revisit only the important ones here.

Check the annual reports and SEC filings and you will see that a majority of the management team has been with the company for over 10 years. For executives to remain at the company, the company must be offering a killer retention package or the work culture must be brilliant for executives to remain for so long.

Management is very candid and shareholder friendly. They are very open about issues they are facing and don’t try to hide it. Their straight forwardness can be seen as downright scary.

Financial Health

Close to zero long term debt, no leverage to run the business, plenty of cash on hand, strong CROIC shows that KSWS is financially quite strong. Even in current economic and difficult times, they should be able to get by with the $8 cash per share in hand.

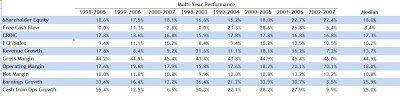

Click the image below to see KSWS financial performance from my intrinsic value spreadsheet.

Opinion

From the spreadsheet, the intrinsic value comes out to be $19.86. Add the current cash per share of $8 and the intrinsic value comes out to be around $28. This may seem like a cheap stock but considering K-Swiss is not expected to produce a turnaround until 2009, money can be used best elsewhere. Their narrow moat and volatility risk isn’t something to ignore for those that are price sensitive.

I on the other hand bought with such a huge margin of safety that even at current $16 levels, I am just below breaking even. I am going to stick with this one and see how things progress.

If you find any bias in this post, forgive me as I may still have ownership pride. I am still human after all.